CQG QTrader Latest Features

Now with CQG Mobile included at no additional cost*. Trade anytime, anywhere.

We continue to roll out CQG QTrader features and enhancements that make it the professional trader's go-to platform. Don't waste your time with the competition. With CQG QTrader, you get access to all the trading and analytics tools you need, and you can now leverage our mobile app to further empower your trading.

* transaction rates still apply

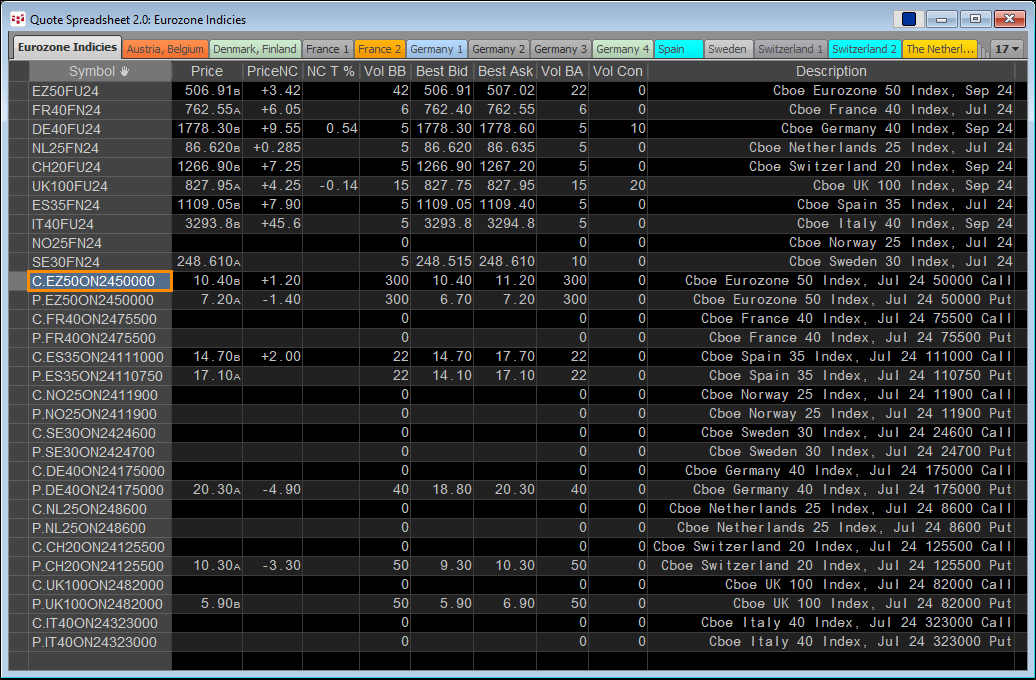

Connect to the Cboe Europe Derivatives Exchange (CEDX)

CQG is now live with Cboe Europe Derivatives Exchange (CEDX), which is CQG's first offering of equity options, expanding the company's asset class offering to include futures, options on futures, equities and equity options on a single platform.

CEDX offers a range of futures and options contracts based on Cboe Europe single country indices.

CEDX offers European equity options for quotes and trade execution on over 300 companies.

Introducing "Trade Clear"

Previous versions of CQG IC and QTrader cleared daily market values, such as open, high, low, and close from quote displays and the daily value for a chart when a particular market closed and was in the pre-open state. Now, they are cleared at the "Trade Clear" - 15 minutes before the open of the first trading session (generally, in the evening). This change applies to a limited set of commodities including ZSE, ZWA, ZLE, ZME, HE, GLE.

Read more from the Help file.

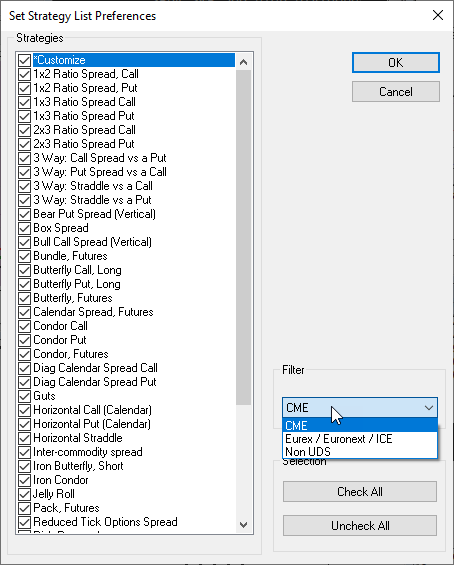

UDS and Strategy Analysis Upgrade

The UDS functionality has been significantly updated with many more strategies and the ability to filter the Strategy Analysis window to list those suitable for trading at the CME, those suitable for trading at Eurex, Euronext, and the ICE exchanges, and those that are not tradable UDS symbols.

The two first groups intersects: there are strategy definitions that would be accepted both by CME and by Eurex/Euronext/ICE. The user selects which of the three groups shall be used; by default, the CME set of strategies is selected. For more details, please read the Help File.

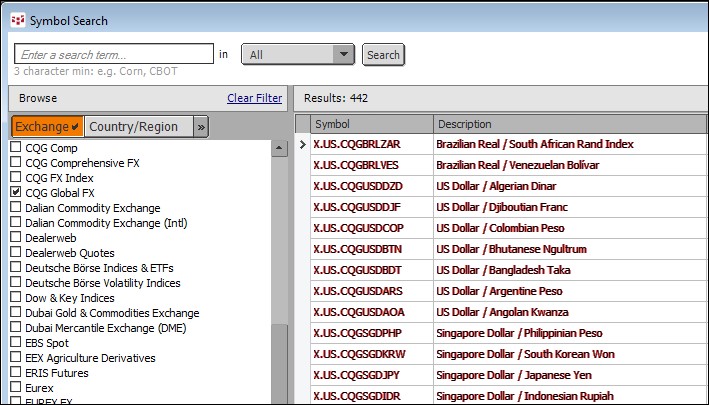

New Data Feed for Spot FX, FX Forwards, and Precious Metals

TDL has partnered with Netdania, creating an institutional market data offering integrated into CQG's trading platforms. Sourced directly from tier-1 banks and non-bank market makers worldwide, the feed provides accurate and reliable pricing data across 430+ currency pairs. Up to 50 years of historical data across multiple timescales is available. IC/QTrader customers please contact CQG Sales/Support. For Desktop/One customers contact your broker. The enablement is CQG Global FX