Solution: Market Data

Broad global coverage

CQG is a powerful partner for firms trading equities. With global coverage, we offer firms access to major US, South American, European, and Asian equities markets. Our customers rave about the edge they have with CQG because they can trade multi-asset stocks / futures pairs and spread strategies, something not readily available on other platform providers.

CQG is the trusted partner and exchange front end for the Nasdaq Nordic Equities exchange group. Our partnership with NASDAQ provided an opportunity to expand our equities coverage and enhance our front-ends to better fit the needs of global equities trading firms, including better search and display filters for stocks.

Solution: Spreader

Pairs Performance

CQG Spreader enables firms to spread stocks versus futures, stocks versus stocks, create synthetic baskets of stocks to spread versus stocks (including ETFs) or versus futures. Our spreader offers pre (sniper mode) and post (payups) hedge logic. CQG offers Order Following studies that enable traders to never miss a trade based on a study in both stocks and futures.

Solution: CQG XLS Trader

Powerful Integration and Automation

The CQG XLS Trader Add-in for Excel, another CQG exclusive, connects Excel via the CQG IC Trading API to the CQG Gateway for trade routing and order management. Build models in Excel using Microsoft® RTD technology to pull in real-time market and study data from CQG IC and Excel automatically routes and manage orders.

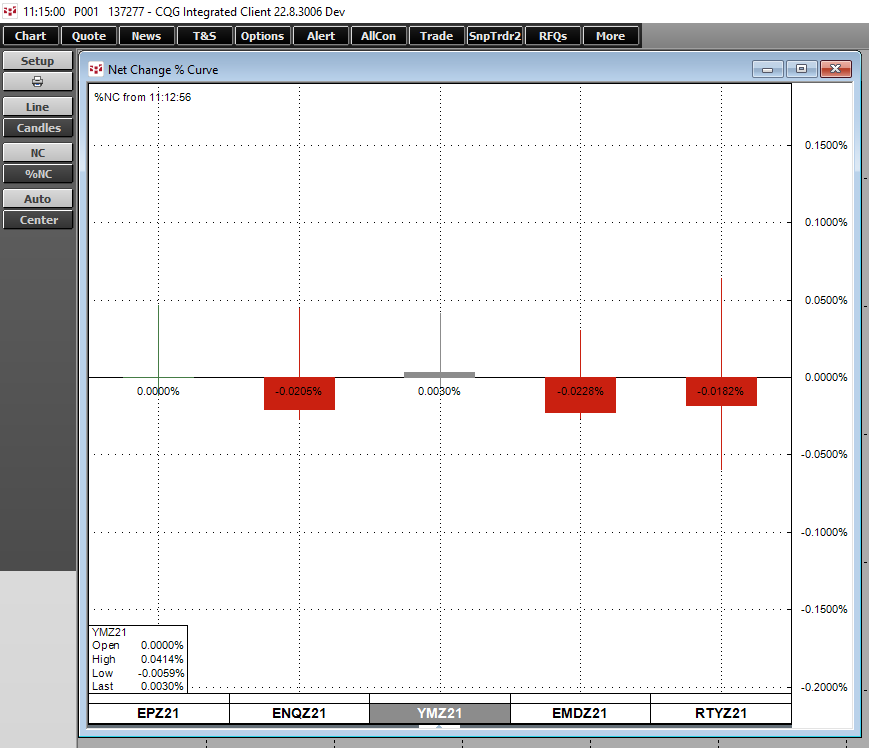

Solution: Data Visualization

A Powerful View for Change

CQG’s exclusive newest addition to our analytical package is the net change or net percent curve charts that can be reset to zero at any time and the market changes are tracked from the users starting point.

It is designed to compare price changes for multiple markets from specific points in time, such as following key economic releases. Instantly know which markets are leading and which are lagging within the group following the economic release.