Challenge

Manual workflow holding you back?

Manual processes are expensive, cumbersome, and have a greater risk of errors. Along the physical commodity supply chain, there are many points of contact handled over the phone with pen and paper.

- Risk of price slippage due to antiquated workflow

- Too many manual processes and steps to place a trade

- Too many phone calls to deliver pricing

- Increased overhead limiting the number of customer and quality of service

Solution

Become your customers' favorite partner through trust, transparency and efficiency

- Speed: Act fast and manage risk across your organization with CQG's easy-to-use risk management system

- Flexibility: Set up risk limits in multiple ways

- Access: Browser based use from anywhere around the world

CQG maintains world class leadership in the futures trading industry by developing leading edge technology that is easy to use on CQG’s proven infrastructure.

CQG offers a software solution that provides tools for each of your customers along the supply chain.

All-in-One Customer Portal

Benefits

- Full service customer portal

- Efficiency of a single, common platform

- End-to-end trade lifecycle management

- High customer satisfaction

- Robust risk infrastructure

Key Features

- Monitor the markets and place orders for futures and options

- Tradable basis price distribution eliminates large GTC order books

- Customize the software with your brand

- Mobile apps for iPhone and Android

- Award-winning customer support

Contact our solutions team for more information

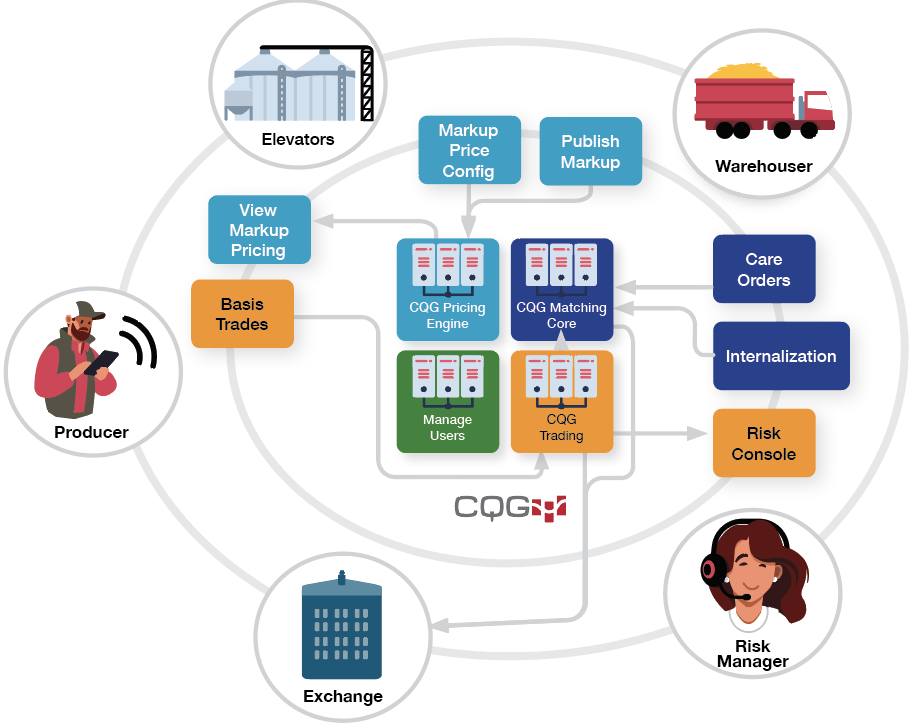

How it works

CQG and partners collaborate to configure solutions to solve particular challenges

Producers: Easy-to-use Mobile Tools

- CQG's platforms help producers with visibility of bids and offers from elevators.

- Place basis trades simply and quickly without having to make a call.

Elevators: Optimize interactions with Producers: Publish Bids & Offers

- Provide customers with real-time product information

- Increase your sales by publishing customized prices and contract sizes through bid/offer screens

- Bid pricing for producer product

- Product pricing for fertilizer, herbicides, feed and more

- RFQ and response tools, internal matching engine, and flexible integrations optimize custom pricing operations.

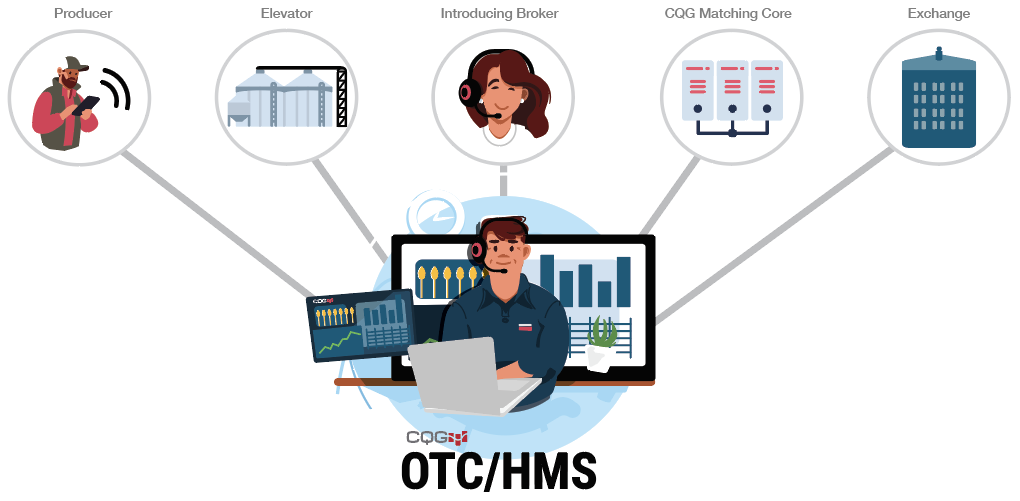

Central Desk: Total Risk Control and Optimization

Reduce overhead, increase transparency, and run a more efficient hedge desk by using a modern, digital platform across producers, manufacturers, and central desk.

- Create and quote custom priced products to elevators and producers

- Streamline risk management process with comprehensive hedging technology

- Setup and manage producer accounts versus order desk accounts and maintain an aggregate view of risk across all accounts.

- Automatically or manually match orders internally or route to the exchange