Hedge Management

Challenge

Manual processes are expensive and error prone

Manual processes are cumbersome, and result in greater risk of errors. Along the physical commodity supply chain there are several points of communication, still handled person to person. Transactions are often recorded with pen and paper or a spreadsheet. Often futures and grains back office systems are different platforms.

These manual processes become expensive when they take so much time, they prevent you from expanding your customer base being able to scale.

Solution

Digital efficiency and modern tools

CQG offers an end to end solution for hedge management that includes custom contract creation and price dissemination per user or group. Offering custom priced products on a front end screen increases transparency, and streamlines the order and risk management process. Our tools provide advantages for everyone along the supply chain; from mobile apps for viewing custom contracts, to custom contract creation and custom pricing per user or group, and a common order identifier across systems, CQG’s trading capabilities make it easier than ever to manage your commercial operation.

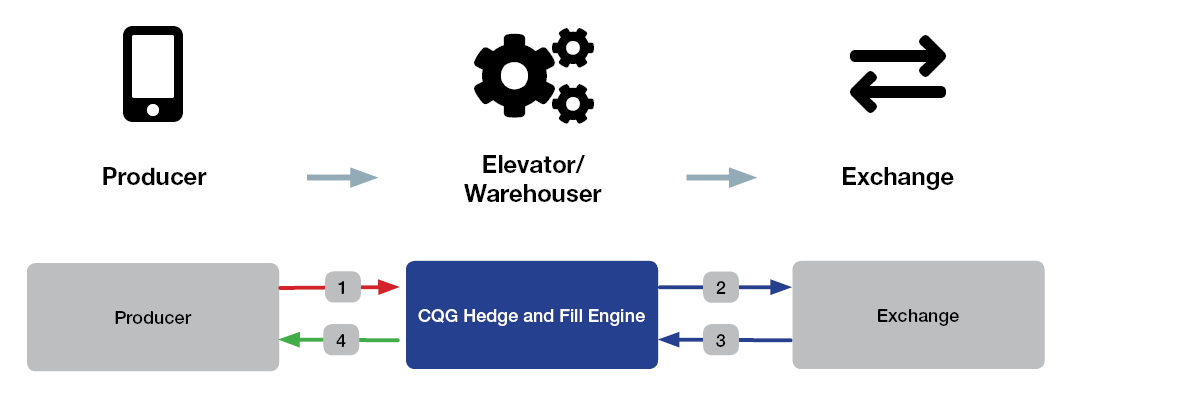

How it works

CQG's Hedge Management System

- Producer places order to Sell product to Elevator/Warehouser.

- CQG HMS automatically places hedge order at exchange for the Elevator/Warehouser

- Hedge order is filled

- CQG HMS automatically fills Producer's order with cash for the Elevator/Warehouser

See how CQG's Hedge Management is helping commercial grains firms

Optimized to handle the industry’s evolving needs, CQG for Hedge Management helps commercial agribusiness and farmers collaborate across entire ecosystems, get new products to market faster, turn valuable data into actionable insights, and revolutionize farming.

See how CQG's Hedge Management is forging new efficiencies in metals

Increase productivity with CQG's Hedge Management and Custom Pricing Solutions for your entire operation.