Comprehensive risk and account managment

CQG's risk management module enables brokers to perform pre-trade and post-trade risk evaluation using a wide variety of parameters. Margin analysis is performed on a real-time basis, so incoming orders can be monitored for increasing account risk. Account types supported include single, give-up, and group accounts with shared purchasing power. CQG's Customer Account Service Tool (CAST) is an easy-to-use interface for brokers and support personnel to manage accounts and orders. CQG provides in-depth CAST training to our partners.

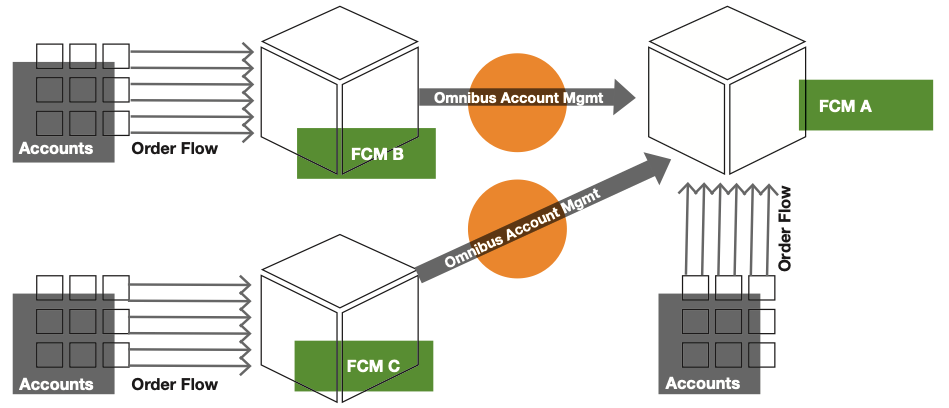

Robust Management of Omnibus Accounts

CQG makes it easy for you to efficiently and securely increase your business by offering non-disclosed account services (omnibus accounts) to non-clearing FCMs. CQG's real-time risk engine can be applied to omnibus accounts with the same speed and effectiveness as to individual accounts. All of the standard risk parameters can be used to manage your omnibus accounts. In addition, your omnibus account client can manage all subaccounts using the same features of CQG's risk management system.

State-of-the-Art Margining

CQG provides the tools that allow you to manage risk on both an order and account basis. More importantly, we provide superior tools for managing account balances in real time. CQG's risk engine is one of the most advanced in the industry. We maximize your protection by using exchange-published risk arrays in our calculations and by determining margin account requirements on the basis of overall portfolio risk (a SPAN®-like calculation*).

Flexible Group Accounts

CQG's risk management system allows you to create master accounts with highly flexible subaccounts that share purchasing power, exposure, or both.

Fast, Cost-Effective, and Real-Time

CQG's risk management system is designed for speed. It is hosted on CQG's servers and adds less than one millisecond to any trade while applying one of the most advanced risk engines. You receive all the cost-effective protection you want, and your traders receive all the speed they need. CQG's risk management system includes the Customer Account Service Tool (CAST), an easy-to-use, browser-based tool for brokers and support personnel to manage accounts and set risk parameters.

Risk Based on Working Orders

It is not enough to analyze risk based only upon open positions and the current state of the market. Working orders have the potential to increase risk and must be incorporated into your portfolio's risk analysis. CQG's risk management system makes sure you are never in a position where a customer's working orders have added, unwanted risk.

Exclusive Route-Based Risk Control

CQG is one of the first in the industry to provide comprehensive, route-based risk management. CQG's route-based solution allows you to establish order and position size control over exchange routes. With multiple routes per exchange, you can manage your exchange exposure. Using route-based risk management allows you to efficiently manage your exchange relationships on an exchange-by-exchange basis.

See how CQG's risk tools are helping brokers

*SPAN® is a registered trademark of CME Group.