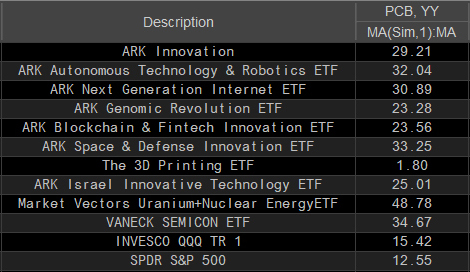

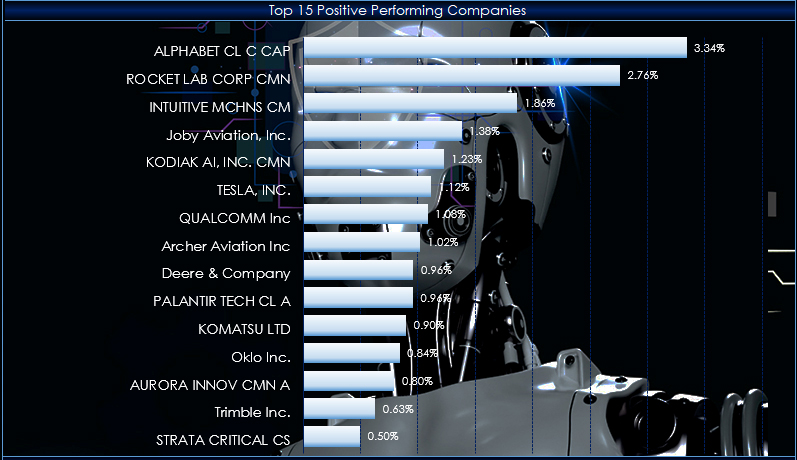

Stories are appearing in the media pointing out the possibility of an AI bubble. Alternative ETFs have been suggested that are not so "tech heavy." One suggestion is the Invesco S&P 500® Quality ETF (Symbol: SPHQ).

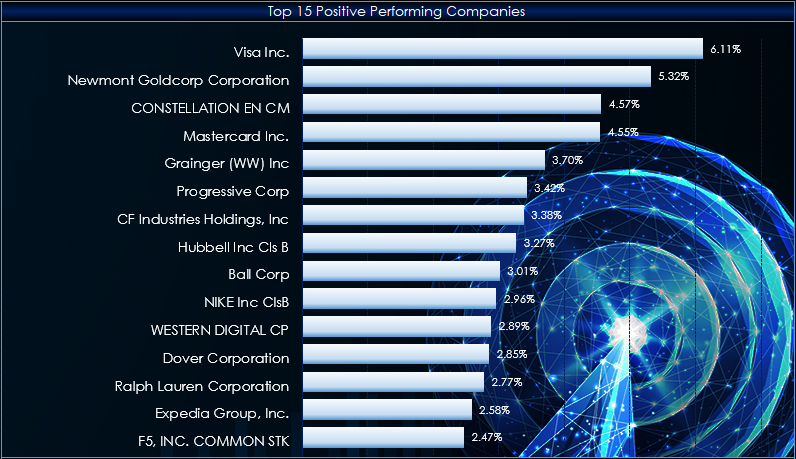

According to their web site: "The Invesco S&P 500® Quality ETF (… more