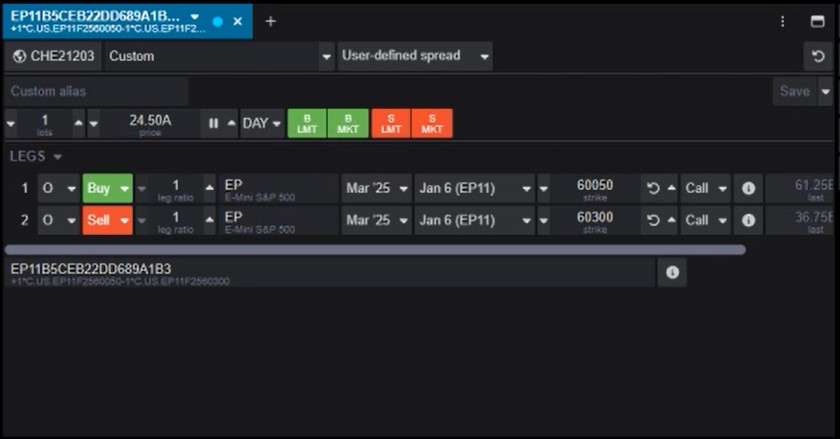

Strategy builder was added in Version 9.9 and replaces Spread Builder.

Strategy Builder

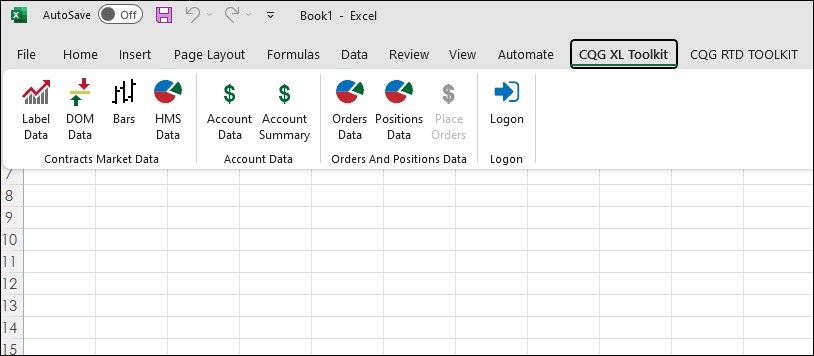

Improved synthetic strategy supportAdded keyboard navigationCustomizable toolbarsThis video by CQG Product Specialist Jim Stavros details the steps to setting up a page in CQG One for trading a… more