CQG Latest Features

The following features and enhancements are available in CQG Integrated Client (CQG IC).

Use Exchange Source Symbols

CQG IC version 2026 and QTrader version 2026 can resolve symbols when combined with a Market Identifier Code (MIC) prefix and the Exchange Symbol. For example, using CME (for CME Group) and ZN (the Exchange symbol for the 10-year Treasury Note) i.e., CME(ZN) will resolve to the 10-year Treasury Note traded on the CME.

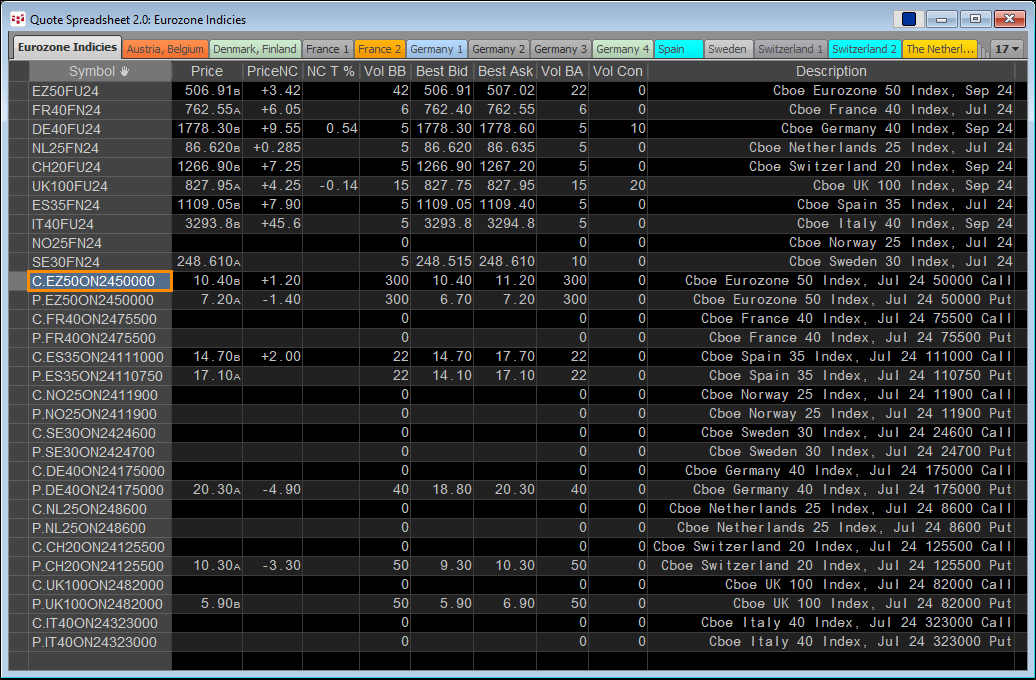

Connect to the Cboe Europe Derivatives Exchange (CEDX)

CQG is now live with Cboe Europe Derivatives Exchange (CEDX), which is CQG's first offering of equity options, expanding the company's asset class offering to include futures, options on futures, equities and equity options on a single platform.

CEDX offers a range of futures and options contracts based on Cboe Europe single country indices.

CEDX offers European equity options for quotes and trade execution on over 300 companies.

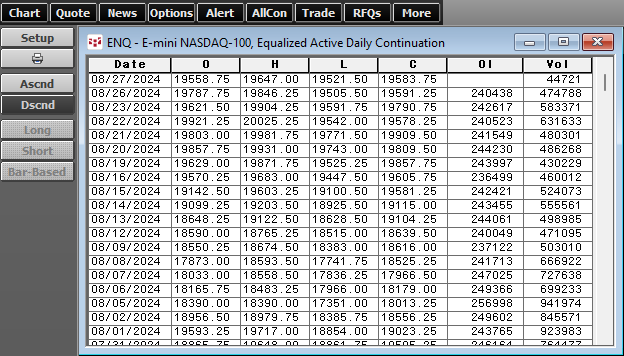

Export 1,000 bars of chart data to Excel

Customers can export 1,000 bars of chart data to Excel using Excel/RTD functions and copy to the clipboard from the Chart/Tabular Display.

In addition, API customers can now pull more historical daily bars.

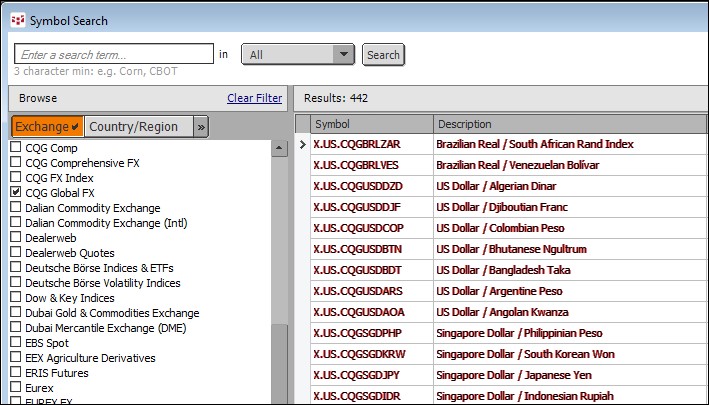

New Data Feed for Spot FX, FX Forwards, and Precious Metals

TDL has partnered with Netdania, creating an institutional market data offering integrated into CQG's trading platforms. Sourced directly from tier-1 banks and non-bank market makers worldwide, the feed provides accurate and reliable pricing data across 430+ currency pairs. Up to 50 years of historical data across multiple timescales is available. IC/QTrader customers please contact CQG Sales/Support. For Desktop/One customers contact your broker. The enablement is CQG Global FX

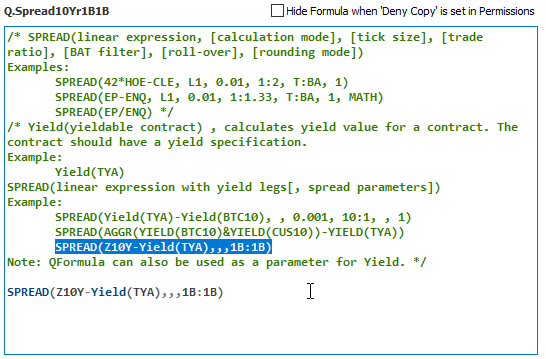

Synthetic Spread Strategies Upgrade

Fixed income traders know that FI markets that are yield based products move in the opposite direction as price based products. The Trading Ratios parameter has been upgraded to deal with this.

If you define a spread as SPREAD(Z10Y-Yield(TYA),,,1B:1B) then the additional B in the trading ratio is buying this spread means buy 1 Z10Y and buy 1 TYA. S is also available.

Here is a link to the Help file.

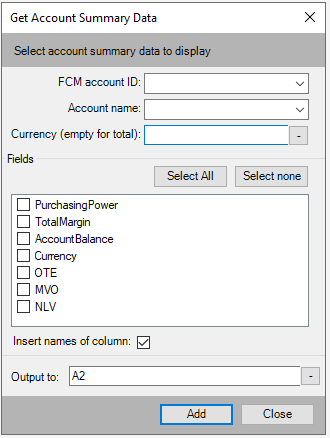

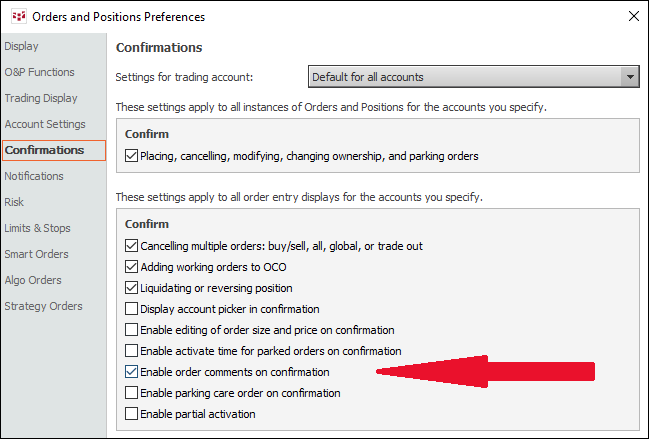

Enable Comments from Trading Confirmations

You can add a comment to an order when you confirm the order. In order to enter comments, select via Trading Preferences/Confirmations setting.

For more information, please read the Help File.

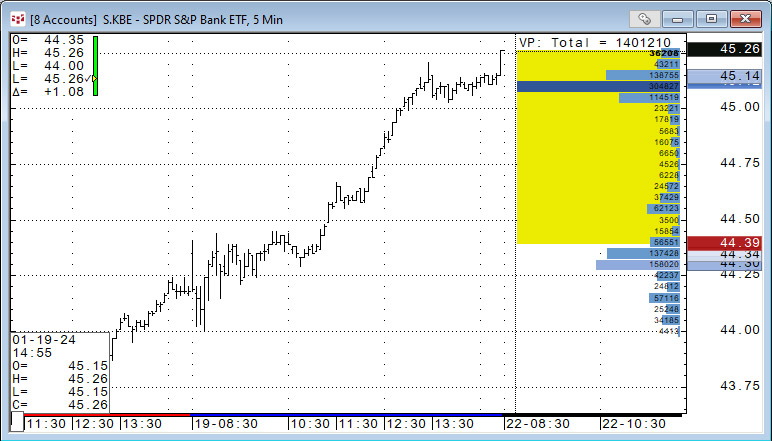

Display the Day's Total Volume on the Volume Profile Study

The Volume Profile study displays the total volume in VP header. To enable the feature select "Total" from the Study Parameters Display Bars-Display.

For more details, please read the Help File.

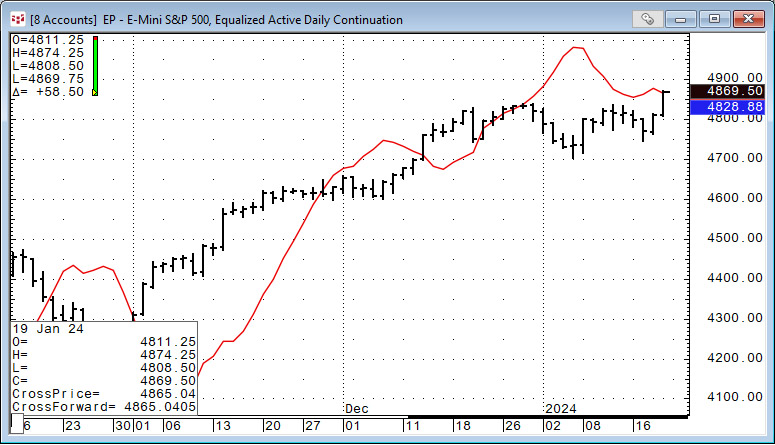

DiNapoli MACD Predictor (DMACDP) Study

The DMACDP is a derivative of the MACD with specific inputs. It is a leading indicator as it places a point one period ahead of the current bar and updates in real time as market data unfolds.

For more information, please read the Help File.